Manish Dhameja’s Record in Innovative Credit Card Use

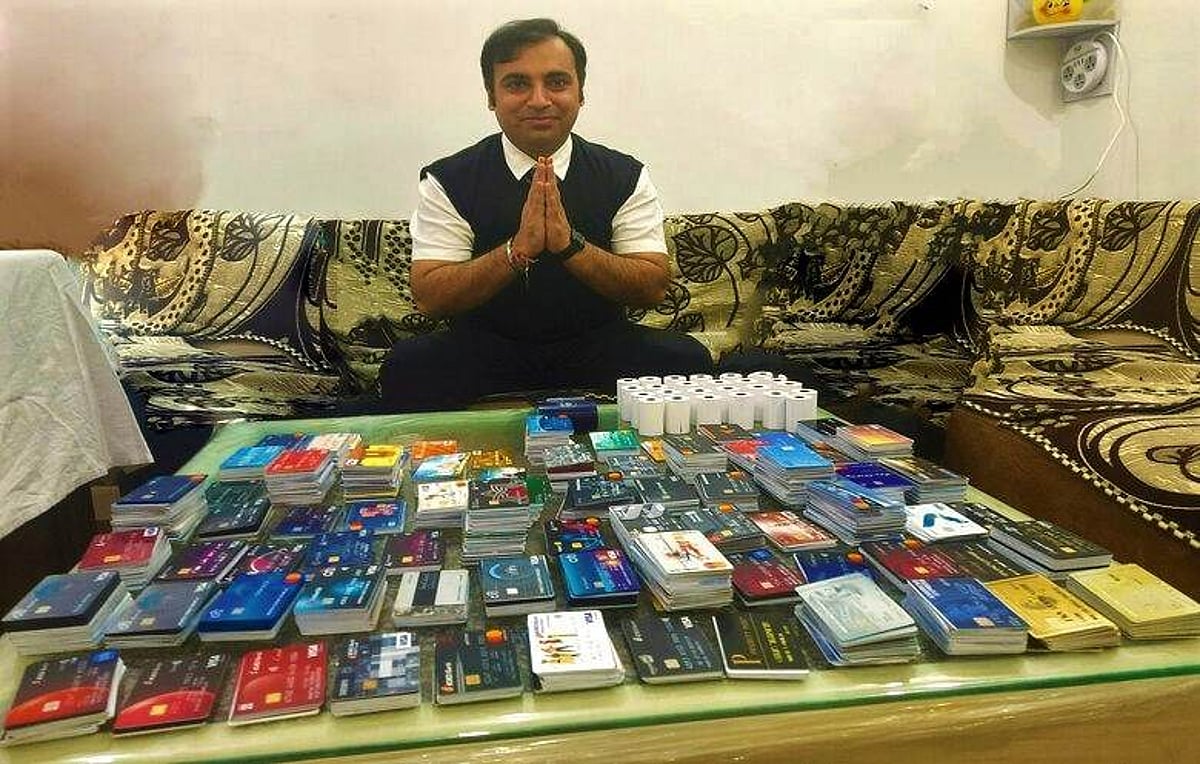

In a remarkable feat, a tech professional from Kanpur, India, has redefined the way credit cards are utilized. Manish Dhameja has not only amassed an impressive collection of credit cards but has also turned them into a source of income, all while remaining debt-free. His innovative approach earned him a Guinness World Record on April 30, 2021.

A Unique Strategy for Credit Card Use

Currently, Dhameja holds 1,638 valid credit cards, which he employs strategically to maximize rewards, cashback, travel benefits, and hotel privileges. His method demonstrates that credit cards can be more than just spending tools; they can also serve as effective instruments for earning.

In his Guinness World Records profile, Dhameja expressed his passion for credit cards, stating, “I think my life was incomplete without credit cards. I just love credit cards. I enjoy complimentary travelling, railway and airport lounges, hotel vouchers, free movie tickets, golf sessions, and fuel benefits — all through milestone rewards, airmiles, and cashback.”

Navigating Financial Challenges

Dhameja’s innovative use of credit cards proved particularly beneficial during India’s 2016 demonetization, when high-denomination currency notes were withdrawn from circulation. He recalls the chaos that ensued, with people scrambling for cash. “At that time, credit cards played an important role in my life. I didn’t have to rush for cash — I was just enjoying spending digitally,” he noted.

Educational Background

Manish Dhameja’s educational qualifications include a Bachelor of Computer Applications (BCA) in Physics, Chemistry, and Mathematics from CSJM University in Kanpur, a Master of Computer Applications (MCA) from Integral University in Lucknow, and a Master of Social Work from IGNOU. His academic background complements his innovative approach to financial management.

FAQs

How does Manish Dhameja manage so many credit cards?

Dhameja strategically uses each card to maximize rewards and benefits, ensuring he keeps track of their usage and payment schedules to avoid debt.

What benefits does he receive from his credit cards?

He enjoys various perks, including cashback, travel rewards, hotel vouchers, and access to exclusive lounges, all of which enhance his lifestyle without incurring debt.

Can anyone replicate Dhameja’s success with credit cards?

While his strategy is unique, individuals can adopt similar practices by researching and selecting credit cards that offer rewards aligned with their spending habits, provided they manage their finances responsibly.

Conclusion

Manish Dhameja’s journey illustrates how innovative financial strategies can transform everyday tools into valuable assets. His record-setting achievement serves as an inspiration for others to explore the potential of credit cards while emphasizing the importance of responsible financial management. As more people look to optimize their credit card usage, Dhameja’s story highlights the possibilities that lie within smart financial planning.

Dhameja’s achievement has sparked interest in the broader implications of credit card usage in India, a country where digital payments have been on the rise. The Indian government has actively promoted cashless transactions, particularly following the demonetization initiative, which aimed to reduce the shadow economy and increase tax compliance. As a result, many consumers are now exploring various financial products, including credit cards, to facilitate their spending while enjoying the associated benefits.

The credit card industry in India has seen significant growth in recent years, with banks and financial institutions introducing a variety of products tailored to different consumer needs. This evolution has led to increased competition among issuers, resulting in enhanced rewards programs and promotional offers. Dhameja’s success story exemplifies how consumers can leverage this competitive landscape to their advantage, provided they remain disciplined in their financial habits.

Moreover, Dhameja’s approach underscores the importance of financial literacy in navigating the complexities of credit management. Understanding the terms and conditions associated with credit cards, including interest rates, fees, and reward structures, is crucial for anyone looking to replicate his success. As more individuals become aware of the potential benefits of credit cards, there is a growing need for educational resources that empower consumers to make informed decisions about their financial futures.

Also Read:

Consequences of Missing Credit Card Payments in the UAE