Oman Delays Digital Tax Stamp for Beverages to 2026

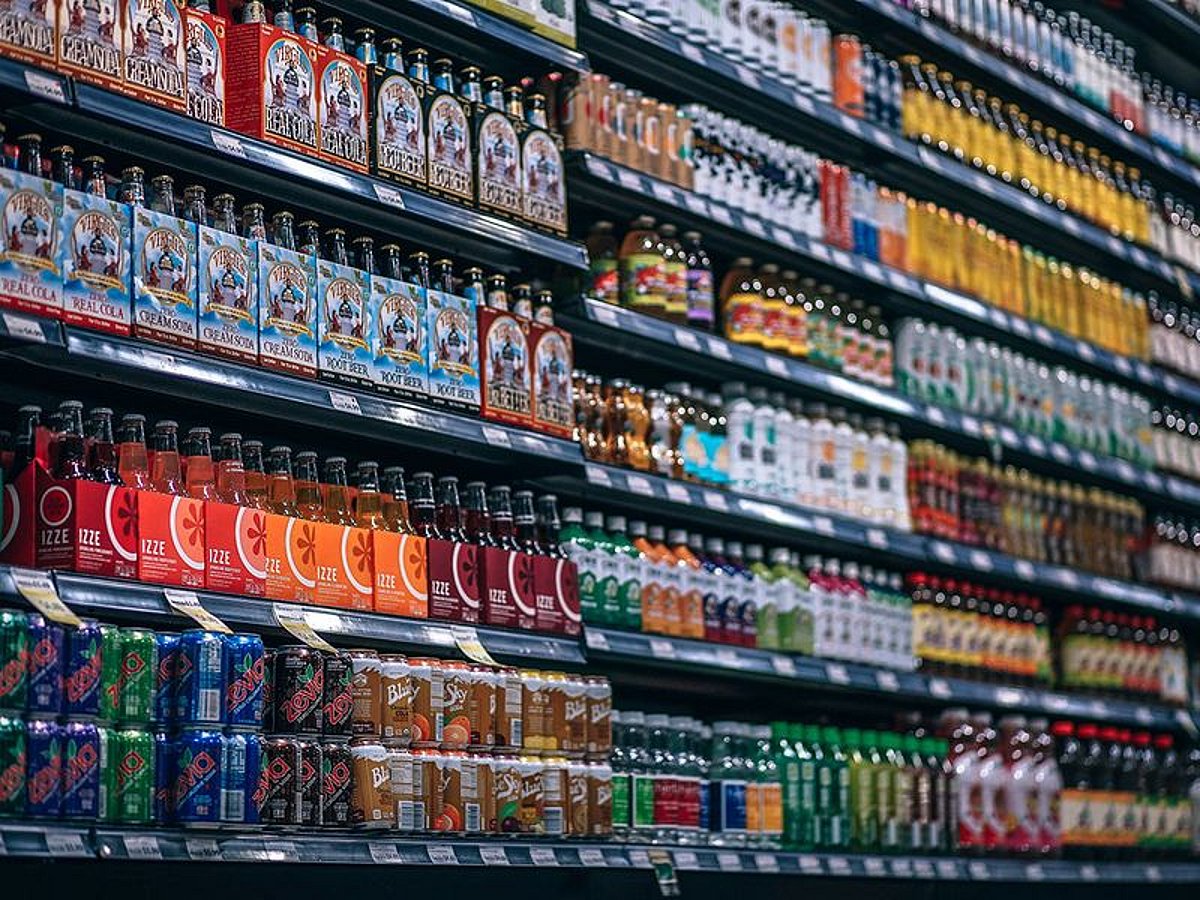

Oman’s Tax Authority has announced a significant delay in the rollout of the Digital Tax Stamp system for certain beverages. This postponement provides businesses additional time to comply with the new labeling requirements, which are aimed at enhancing tax compliance and market regulation.

New Implementation Date

Originally set to begin on November 1, 2025, the implementation of the Digital Tax Stamp for soft drinks, energy drinks, and other selected beverages has been rescheduled to January 1, 2026. This change applies specifically to products that do not include sweetened drinks.

Compliance Requirements

The Tax Authority has emphasized that all importers, producers, and retailers must ensure that the approved tax stamps are affixed to their products by the new deadline. Failure to comply will result in strict prohibitions against the sale or circulation of unstamped products within Oman starting January 1, 2026. This measure is part of the government’s broader strategy to improve tax collection and market integrity.

FAQs

What are Digital Tax Stamps?

Digital Tax Stamps are unique identifiers that are affixed to products to ensure proper tax collection and compliance with local regulations.

Why was the implementation date postponed?

The postponement was made to give businesses more time to adapt to the new tax labeling requirements, ensuring a smoother transition and compliance.

What happens if businesses do not comply by the new deadline?

Businesses that fail to affix the required tax stamps by January 1, 2026, will face restrictions on the sale and circulation of their products in Oman.

Conclusion

The delay in the Digital Tax Stamp implementation offers businesses a crucial opportunity to prepare for compliance. As the new deadline approaches, companies should prioritize affixing the necessary stamps to avoid penalties and ensure continued market access.

The introduction of Digital Tax Stamps in Oman is part of a larger trend among countries seeking to modernize their tax systems and enhance revenue collection. Many nations have adopted similar measures to combat tax evasion and ensure that all products sold in the market are properly taxed. By implementing a digital tracking system, Oman aims to create a more transparent and accountable marketplace, which can ultimately benefit both the government and consumers. The use of technology in tax administration is increasingly seen as a necessary step to keep pace with evolving market dynamics and consumer behaviors.

The decision to delay the implementation of the Digital Tax Stamp system reflects the Omani government’s recognition of the challenges faced by businesses in adapting to new regulatory frameworks. The beverage industry, in particular, has been under scrutiny due to concerns about health and taxation policies. By extending the deadline, the Tax Authority is allowing stakeholders to better prepare for the transition, which may involve adjustments in production processes, supply chain logistics, and marketing strategies. This additional time can also facilitate better communication between the government and businesses, ensuring that all parties are aligned on compliance expectations.

As Oman moves towards the new implementation date, it is crucial for businesses to engage with the Tax Authority and seek guidance on the requirements for the Digital Tax Stamp. This proactive approach can help mitigate potential disruptions in the supply chain and avoid penalties associated with non-compliance. Furthermore, companies may benefit from investing in training programs for their staff to ensure that everyone involved in the production and distribution processes understands the new regulations. The successful adoption of the Digital Tax Stamp system could serve as a model for future tax initiatives in Oman, promoting a culture of compliance and accountability in the long term.

The beverage sector’s adaptation to these new requirements may also influence consumer behavior, as products with proper tax stamps could be perceived as more legitimate and trustworthy. This shift could enhance consumer confidence in the market, ultimately benefiting both businesses and the economy as a whole. As the deadline approaches, it will be important for all stakeholders to remain informed and engaged in the process, ensuring a smooth transition to the new system and fostering a more robust regulatory environment in Oman.

Also Read:

UAE First-Term Exams Begin November 20, 2025