Gold Prices in UAE Near Dh500 Amid Global Tensions

Recent fluctuations in gold prices have captured the attention of investors and consumers in the UAE. Following a significant increase, the price of 24-karat gold is nearing the Dh500 mark per gram, driven by global economic tensions and expectations of interest rate cuts.

Current Gold Prices in the UAE

As of Monday evening, the price of 24K gold rose to Dh493.25 per gram, a notable increase of Dh9 from the previous day’s price of Dh484.25. Similarly, the price of 22K gold climbed to Dh456.75, up from Dh448.25. This surge reflects a broader trend, with gold prices having risen over Dh80 per gram in the past two months. For context, at the beginning of October, 24K gold was priced at Dh466.75, while 22K gold was at Dh432.

Global Influences on Gold Prices

The global gold market has seen prices exceed $4,100 per ounce, marking a new record. Investors are increasingly turning to gold as a safe haven amid rising concerns over U.S.-China trade relations and the potential for interest rate cuts by the U.S. Federal Reserve later this year. The ongoing geopolitical tensions have prompted a shift toward gold, which is traditionally viewed as a secure asset during times of uncertainty.

Market Predictions and Economic Factors

Major financial institutions are adjusting their forecasts for gold prices. Bank of America anticipates an average price of $4,400 per ounce by 2026, while Societe Generale predicts it could reach $5,000 per ounce by the end of next year. As interest rates decline, the appeal of gold increases, as it does not yield interest but offers a hedge against inflation and economic instability.

Current market indicators suggest a 97% probability that the Federal Reserve will lower interest rates by 25 basis points in its upcoming meeting. This anticipated move is a significant factor contributing to the rising gold prices globally.

Geopolitical Tensions and Economic Uncertainty

The U.S.-China trade relationship remains a focal point of concern. Recent threats of tariffs from President Trump have added to market volatility, although he later indicated a more conciliatory approach. As both nations continue to negotiate trade terms, investors remain cautious.

Additionally, the ongoing U.S. government shutdown has delayed the release of critical economic data, further complicating the financial landscape. In times of political and economic turmoil, gold often sees increased demand, and the current situation is no exception.

Implications for UAE Consumers

For consumers in the UAE, the rising gold prices present a challenging decision-making scenario. With prices consistently climbing since September, many are left pondering whether to purchase gold now or wait for potential price stabilization. Jewelry buyers are already feeling the impact of these increases, while long-term investors view this trend as a reaffirmation of gold’s status as a reliable investment.

As the price of 24K gold approaches the Dh500 mark—a psychological threshold not seen in years—both shoppers and investors are advised to stay informed about global developments and local price trends.

FAQs

What factors are driving the rise in gold prices?

Gold prices are rising due to global economic uncertainties, including U.S.-China trade tensions and expectations of interest rate cuts by the Federal Reserve, which make gold a more attractive investment.

How much have gold prices increased recently in the UAE?

In the past two months, gold prices in the UAE have surged over Dh80 per gram, with 24K gold currently priced at Dh493.25 per gram.

Should I buy gold now or wait for prices to stabilize?

The decision to buy gold now or wait depends on individual financial goals and market conditions. With prices rising, it may be wise to monitor trends closely and consider your investment strategy.

Conclusion

The current surge in gold prices in the UAE reflects a complex interplay of global economic factors and geopolitical tensions. As prices approach the Dh500 mark, consumers and investors must weigh their options carefully, keeping an eye on both local and international developments that could influence future price movements.

Also Read:

Gold Price Trends in the UAE: Current Insights and Predictio

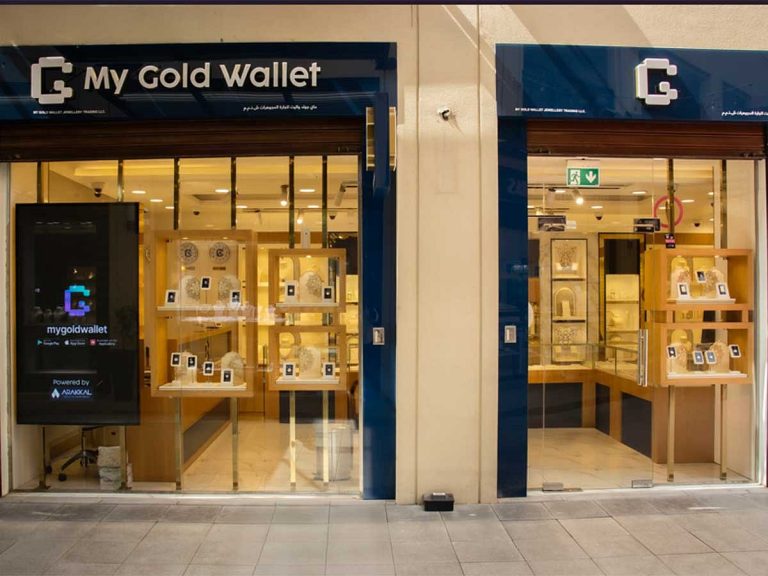

UAE’s My Gold Wallet: A New Digital Gold Investment Platform