US-China Tensions Rise Over Rare Earth Elements Supply

The global landscape of rare earth elements (REEs) has become increasingly contentious, particularly in the context of US-China relations. As both nations grapple with economic and strategic interests, the significance of these critical minerals has surged, prompting discussions about supply chains, tariffs, and national security.

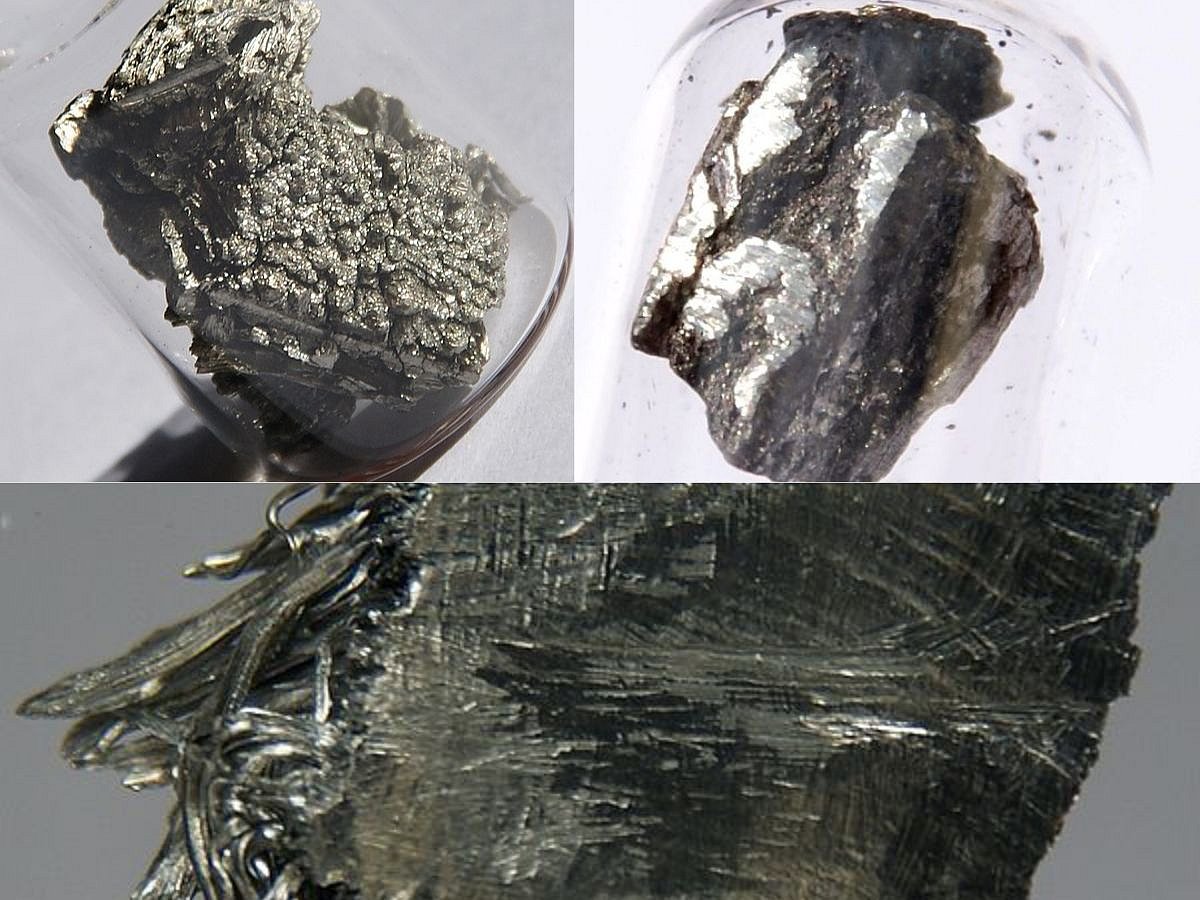

Understanding Rare Earth Elements

Rare earth elements comprise a group of 17 elements, including the 15 lanthanides along with scandium and yttrium. Despite their name, these elements are relatively abundant in the Earth’s crust but are rarely found in concentrated forms that are economically viable for mining. Their unique properties—such as magnetic, luminescent, and catalytic characteristics—make them essential in various high-tech applications.

Applications of Rare Earth Elements

REEs are integral to numerous industries, including:

– **Electronics**: Used in smartphones, computers, and televisions. – **Clean Energy**: Essential for wind turbines, electric vehicles, and fuel cells. – **Medical Devices**: Employed in imaging and diagnostic equipment. – **Defense**: Critical for military applications, including advanced weaponry and communication systems.

The production of permanent magnets, which are vital for motors, generators, and hard drives, accounts for the largest global use of rare earths. Their role in enhancing efficiency and durability across various technologies underscores their importance in modern society.

China’s Dominance in Rare Earth Production

China currently leads the world in rare earth production, controlling approximately 70% of mined output and 87% of refined production as of 2023. The country’s estimated mined output stands at around 240,000 tonnes. China’s dominance can be attributed to several factors:

– **High-Grade Deposits**: The Bayan Obo deposit in Inner Mongolia is one of the largest and richest rare earth deposits globally. – **Extensive Processing Infrastructure**: China has developed a comprehensive supply chain that encompasses mining, refining, and manufacturing. – **Cost Advantages**: Lower production costs enable China to maintain a competitive edge in the global market.

While other countries, including the United States, Canada, and Australia, possess significant rare earth reserves, they face challenges in developing their mining and processing capabilities.

The United States’ Rare Earth Resources

The United States is home to substantial rare earth deposits, with the Mountain Pass Rare Earth Mine in California being the most notable. This facility produced approximately 15.8% of the world’s rare earth supply as of 2020. The Mountain Pass deposit contains various rare earth oxides, including cerium, lanthanum, neodymium, and europium, with proven reserves estimated at around 1.36 million tonnes.

Despite these resources, the US remains heavily reliant on China for rare earth minerals. Several factors contribute to this dependency:

Limited Domestic Processing Capacity

The US has a significant bottleneck in its ability to refine and process rare earth elements. The country lacks sufficient facilities to separate and refine these minerals into usable forms, which hampers domestic production efforts.

Lengthy Permitting Processes

Developing new mines and processing plants in the US can take decades due to stringent permitting and environmental regulations. The average time to secure a mining permit is approximately 29 years, creating a disincentive for potential investors.

Ongoing Efforts to Expand Production

While the US government and industry are investing in expanding domestic rare earth production, progress has been slow. Initiatives aim to increase magnet production from about 1,000 metric tons to 10,000 metric tons annually over the next decade. However, this capacity remains significantly smaller than China’s.

Geopolitical Implications

The geopolitical landscape surrounding rare earth elements has intensified, particularly with recent developments in US-China relations. In response to China’s export controls on rare earth products, the US government announced a 100% tariff on Chinese goods, effective November 1, 2025. This move reflects growing concerns over national security and economic independence.

China’s strategic control over the global supply chain for rare earths poses a challenge for the US and its allies. The reliance on Chinese supplies continues to be a critical issue, as the US seeks to bolster its domestic production capabilities while navigating complex international trade dynamics.

Future Outlook

As the demand for rare earth elements continues to rise, the competition for securing supply chains will likely intensify. The US is actively working to reduce its dependence on China by investing in domestic mining and processing capabilities. However, the lengthy timelines associated with permitting and development mean that the US will remain reliant on imports in the near term.

FAQs

What are rare earth elements used for?

Rare earth elements are used in various applications, including electronics, clean energy technologies, medical devices, and military equipment, due to their unique properties.

Why is the US dependent on China for rare earth elements?

The US dependency on China arises from limited domestic processing capacity, lengthy permitting processes for new mines, and a lack of comprehensive supply chain infrastructure.

What steps is the US taking to increase rare earth production?

The US government is investing in expanding domestic rare earth production and processing capabilities, with initiatives aimed at increasing magnet production and reducing reliance on foreign sources.

Conclusion

The tensions surrounding rare earth elements highlight the complexities of global supply chains and national security. As the US seeks to enhance its domestic production capabilities, it faces significant challenges, including regulatory hurdles and competition from China. The coming years will be crucial in determining how effectively the US can navigate these issues and secure its position in the global rare earth market.

Also Read:

Trump Announces 100% Tariffs on China Over Rare Earths

Understanding the Challenges of Being Benched in Relationshi