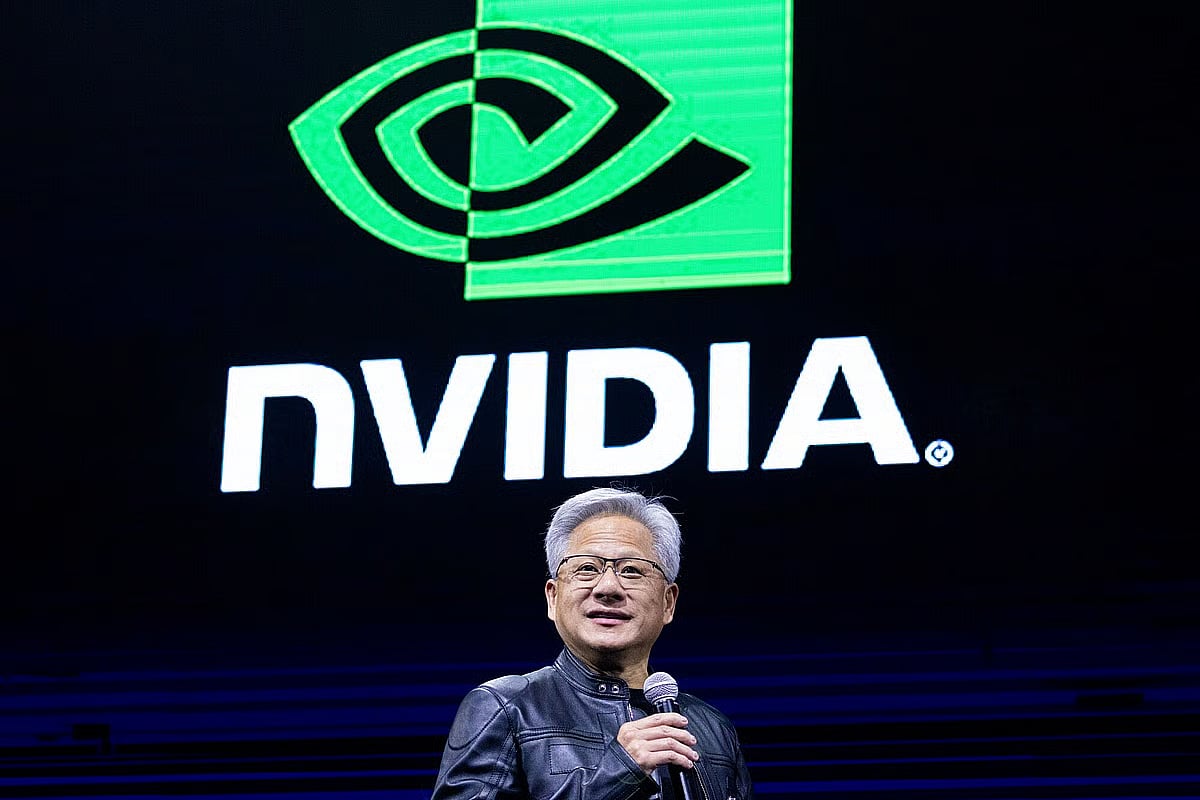

Nvidia Becomes First Company to Hit $5 Trillion Valuation

Nvidia Corp. has made headlines by becoming the first company to achieve a market capitalization of $5 trillion. This milestone comes as the company’s Chief Executive Officer, Jensen Huang, has been actively pursuing partnerships that further fuel the excitement surrounding artificial intelligence (AI). The surge in Nvidia’s stock price reflects growing investor confidence in the transformative potential of AI technologies.

Stock Performance and Market Impact

On Wednesday, Nvidia’s shares rose by as much as 5.2%, reaching $211.47 by 9:36 a.m. New York time. This increase propelled the company past the $5 trillion mark, just four months after it surpassed the $4 trillion threshold. The stock’s impressive performance has been a significant contributor to the broader market, accounting for nearly 20% of the S&P 500 Index’s 17% gain in 2025. In comparison, tech giants Microsoft and Apple are valued at approximately $4 trillion each.

Keith Lerner, Chief Investment Officer at Truist Advisory Services, remarked on the unprecedented nature of Nvidia’s valuation, stating, “A $5 trillion market cap would have been unimaginable a few years ago.” This sentiment reflects the market’s strong belief in AI’s potential to revolutionize various sectors of the global economy.

Strategic Partnerships and Innovations

Nvidia’s recent partnerships with major companies such as Nokia, Samsung, and Hyundai have played a crucial role in its growth. Huang has also dismissed concerns regarding a potential AI bubble, asserting that the latest chips are projected to generate half a trillion dollars in revenue. Additionally, Nvidia has introduced a new system designed to connect quantum computers with its AI chips, further enhancing its technological offerings.

The optimism surrounding Nvidia is echoed by Wall Street analysts, with over 90% of the 80 analysts tracked by Bloomberg recommending the stock as a buy. The average price target for Nvidia shares stands at $225.48, suggesting a potential upside of about 7%.

Valuation and Market Skepticism

Despite its remarkable growth, Nvidia’s shares are currently priced at less than 34 times estimated earnings, which is below the five-year average of approximately 39. This valuation is also competitive compared to the Philadelphia Stock Exchange Semiconductor Index, which is at 29 times earnings. However, some analysts express caution regarding the sustainability of Nvidia’s stock price, especially given its staggering rise of over 1,300% since the end of 2022.

Dan Eye, Chief Investment Officer at Fort Pitt Capital Group, highlighted the potential for Nvidia to lose market share to competitors like Advanced Micro Devices and Broadcom. He noted, “If what everyone is betting on with AI comes to fruition, then valuations are probably justified, but certainly some of it might be difficult to live up to.” This perspective underscores the elevated expectations surrounding Nvidia’s future performance.

FAQs

What factors contributed to Nvidia’s rise to a $5 trillion market cap?

Nvidia’s rise can be attributed to strategic partnerships with major companies, strong investor confidence in AI technologies, and significant stock price gains that have outpaced the broader market.

How do analysts view Nvidia’s stock performance?

The majority of analysts are bullish on Nvidia, with over 90% recommending it as a buy. The average price target suggests a potential upside, indicating strong confidence in the company’s future.

What are the concerns regarding Nvidia’s valuation?

Some analysts express skepticism about the sustainability of Nvidia’s stock price, given its dramatic increases in recent years and the potential for increased competition in the semiconductor market.

Conclusion

Nvidia’s achievement of a $5 trillion market capitalization marks a significant milestone in the tech industry, driven by its strategic partnerships and the growing excitement around AI. While the company enjoys strong analyst support and impressive stock performance, concerns about market competition and valuation sustainability remain. Investors will be closely watching Nvidia’s next moves as it navigates this dynamic landscape.

Nvidia’s ascent to a $5 trillion valuation reflects broader trends in the technology sector, particularly the increasing integration of AI across various industries. The company’s GPUs have become essential for AI applications, driving demand not only in consumer markets but also in enterprise solutions. As businesses seek to leverage AI for competitive advantage, Nvidia’s role as a key supplier positions it favorably for continued growth.

The semiconductor industry is undergoing rapid transformation, with companies racing to innovate and capture market share in AI and machine learning. Nvidia’s advancements in chip technology, particularly in areas like deep learning and data processing, have set it apart from competitors. However, as the market evolves, the company will need to maintain its technological edge while addressing potential regulatory challenges and supply chain issues that could impact its operations.

Also Read:

e& Reports Strong Revenue Growth in Q3 2025