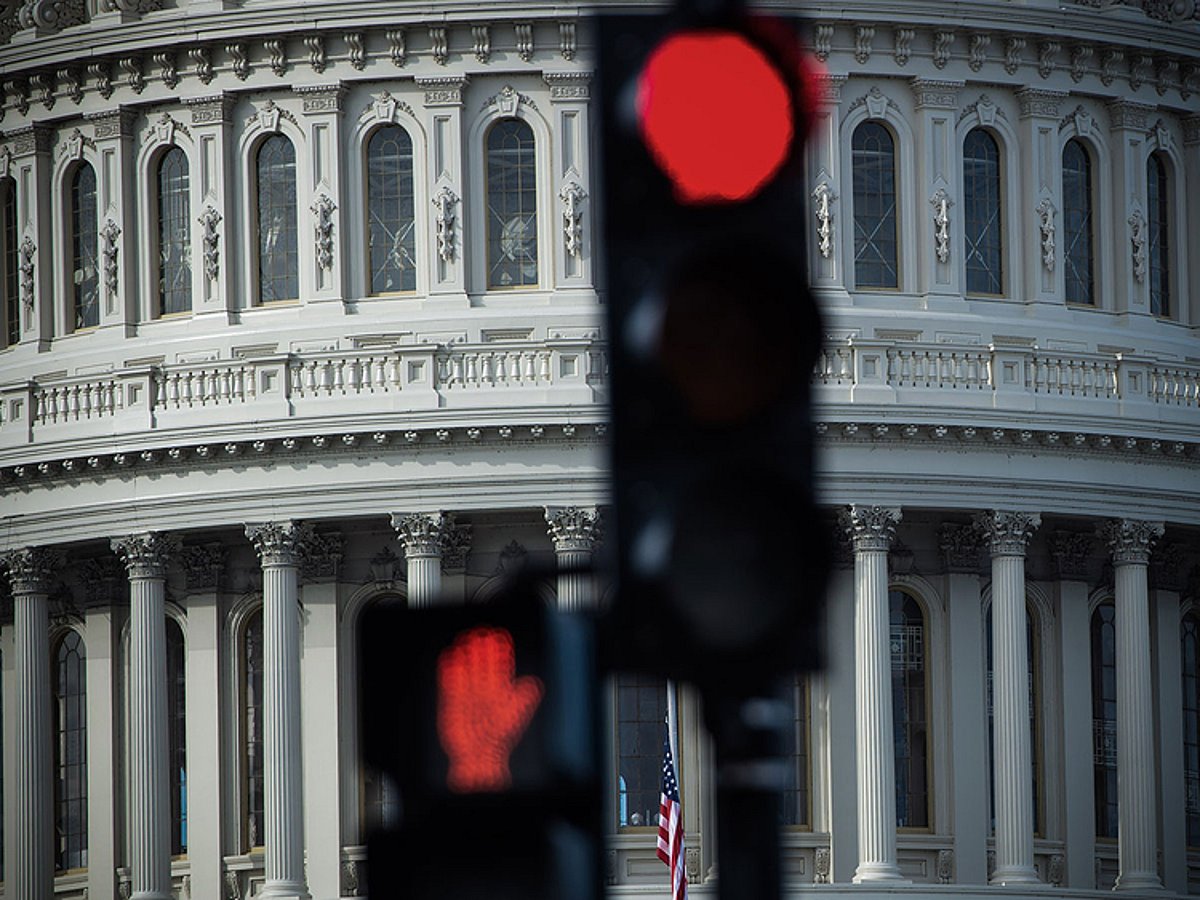

US Government Shutdown’s Impact on Gulf Economies

The recent government shutdown in the United States has sent ripples through global markets, prompting investors to reconsider their strategies. As uncertainty looms over the U.S. economy, Gulf Cooperation Council (GCC) countries are emerging as attractive alternatives for capital investment, showcasing their stability and growth potential.

The Fallout from the US Shutdown

The U.S. dollar has long served as a cornerstone of the global financial system, providing stability and predictability. However, the current government shutdown has raised serious concerns about the U.S. government’s ability to manage its finances effectively. This situation is not merely a temporary setback; it reflects deeper structural issues within the American political system.

The shutdown is costing the U.S. economy approximately $7 billion each week, which translates to a reduction of 0.1 percentage points in the fourth-quarter GDP. Beyond the immediate financial implications, the shutdown has led to significant institutional paralysis. Key government services, including mortgage processing and small business loans, have been suspended, and critical data on jobs and inflation is not being released.

Erosion of Institutional Credibility

Experts are increasingly worried about the impact of this shutdown on America’s institutional credibility. Luke Bartholomew, deputy chief economist at Aberdeen, highlights the political pressures being exerted on the Federal Reserve, which could have long-lasting effects on global capital markets. The uncertainty surrounding U.S. fiscal stability is prompting investors to seek refuge in more reliable markets.

Joe Brusuelas, chief economist at RSM U.S., notes that government shutdowns typically lead to speculative trading in rates and currencies. However, if the current standoff extends for an extended period, similar to the record shutdown from 2018 to 2019, the risks could escalate significantly. Such a prolonged closure could influence the Federal Reserve’s policy decisions and have far-reaching consequences for capital flows and interest rates.

GCC: A Beacon of Stability

In stark contrast to the turmoil in the U.S., GCC countries are positioning themselves as stable havens for global capital. Collectively, these nations manage over $4 trillion in sovereign wealth funds, providing substantial liquidity and investment opportunities. Their ambitious diversification strategies and disciplined fiscal policies are attracting significant foreign direct investment (FDI).

Saudi Arabia’s Vision 2030

Saudi Arabia stands out as a leading destination for capital flows, driven by its Vision 2030 initiative. In the first half of 2025, U.S. companies were involved in 61 greenfield FDI projects in Saudi Arabia, amounting to approximately $2.7 billion. These investments span various sectors, including renewables, advanced manufacturing, logistics, and technology, all aligned with the kingdom’s long-term goals.

The UAE’s Financial Hub

The United Arab Emirates (UAE) is solidifying its status as a global financial center. Dubai’s financial services sector is absorbing wealth that is being reallocated from U.S. equities, while Abu Dhabi is emerging as a leader in green hydrogen, renewables, and fintech innovation. Recent years have seen a surge in FDI inflows, reflecting a strong investor appetite for clean energy and advanced manufacturing.

Qatar’s Strategic Positioning

Qatar is leveraging its leadership in liquefied natural gas (LNG) and making strategic investments in logistics to attract global capital. The country is positioning itself as a hub for supply chain resilience and international trade, appealing to investors looking to diversify away from U.S.-centric risks.

The Dollar’s Decline and the Rise of a Multipolar Financial Order

The decline of the U.S. dollar is not solely a reaction to the current shutdown; it is indicative of deeper structural weaknesses, including soaring national debt and recurring fiscal standoffs. Historically, crises have driven investors toward the dollar; however, the current situation has reversed this trend, with capital flowing out of the U.S. and into emerging markets that offer clarity and stability.

During the recent Saudi-U.S. Investment Forum, officials emphasized the GCC’s role as a cornerstone of global finance. These nations are no longer solely reliant on hydrocarbons; they are actively shaping capital flows across various industries. Sovereign wealth funds are not just absorbing capital; they are strategically redeploying it into global markets, creating a feedback loop of influence.

FAQs

What are the immediate economic impacts of the U.S. government shutdown?

The shutdown is costing the U.S. economy about $7 billion weekly and is expected to reduce the fourth-quarter GDP by 0.1 percentage points, alongside significant disruptions to government services.

How are GCC countries attracting foreign investment?

GCC nations are attracting foreign investment through ambitious diversification strategies, disciplined fiscal policies, and substantial sovereign wealth funds, which collectively manage over $4 trillion in assets.

What sectors are seeing increased investment in Saudi Arabia?

In Saudi Arabia, sectors such as renewables, advanced manufacturing, logistics, and technology are experiencing significant investment, particularly in alignment with the country’s Vision 2030 initiative.

Conclusion

The ongoing U.S. government shutdown is reshaping global capital flows, with investors increasingly turning to the GCC as a stable alternative. As these nations continue to diversify their economies and attract foreign investment, they are poised to play a pivotal role in the evolving landscape of global finance. The situation underscores the need for the U.S. to address its fiscal challenges to regain investor confidence.

Also Read:

UAE Traffic Update: Heavy Delays on Key Dubai Routes Including E11 and E311